The region of Lapland, Finland is buzzing with business activity as companies primarily belonging to three dominant industries – mining, forestry, and tourism – compete for opportunities. Despite evidence of economic growth and job creation stemming from these industries, some local stakeholders view the increased interest with unease as a result of potential negative environmental consequences associated with the growth, particularly with regard to mining. This presents a considerable dilemma; many of Lapland’s entrepreneurs rely on the remarkable brand value of the region to provide strength for their businesses, but industries such as mining directly threaten the natural features that contribute to Lapland’s brand value. This reality raises an important question: how can Lapland continue its growth trajectory without sacrificing its natural environment? This article is exploring sustainable investment in Lapland and proposing an impact-driven, venture capital-supported solution that seeks to drive sustainable development via the region’s small businesses and underinvested industries.

Authors: Daniel Koltonuk & Brett Fifield

Sustainable business in Lapland

Multiple stakeholder groups in Lapland including entrepreneurs, business leaders, the indigenous community, and local government demonstrate great concern for the environment. Lapland, and by extension the broader Arctic region, faces disproportionate risk from climate change and activities associated with the dominant industries (Middleton 2020). Efforts to address this have included the Finnish Network for Sustainable Mining – a platform guided by the Sitra, the Finnish Innovation Fund, for creating best practices for sustainable mining, as well as tourism-related initiatives such as carbon-neutral ski resorts and enhanced waste management during wilderness tours. (Kaivosvastuu 2020 & House of Lapland 2020.)

The business value of Lapland

Factors contributing to the value of Lapland as a destination for entrepreneurs and global companies are numerous, and two key qualities that can be of particular interest to investors: the region’s brand value and its entrepreneur community. Businesses established in Lapland benefit from the tremendous brand value of the region. Comprising this brand value include associations with its pristine wilderness, purity of air and water, climate, unique industries, and cultural assets. Companies incorporate this brand value, for example, by utilizing Arctic themes in their own branding or through specific industrial applications such as cold-weather testing of machinery. (Business Index North 2020.)

Further, the region offers a robust community of entrepreneurs and professionals characterized by their dedication, reliability, passion, and specialized knowledge related to key industries. This is of particular value to investors seeking opportunities in both growth-stage companies requiring skilled labor and startup ventures where committed investor-entrepreneur relationships are paramount.

Perceptions of investors and the regional community

While the demand for natural resources extraction permits, forestry activity, and tourism infrastructure in Lapland is high among businesses and investors, the region faces an issue of investor recognition regarding its less-visible industries and small-scale enterprises. This is particularly the case in areas outside of the main population centers of the region, such as Rovaniemi and the Kemi-Tornio area. Contributing to this challenge are perceptions among investors that Lapland is too sparsely populated, disconnected from the south of Finland, and potentially lacking in skilled labor. However, the region features tremendous infrastructure development, connectedness to the greater Arctic, and expert community of dedicated entrepreneurs and professionals.

Investors may also face difficulties in forming relationships with the local community given several particular issues. This can be characterized by a lack of trust; local stakeholders require reassurance that investors understand their culture and are acting in the best interest of the region – especially with respect to issues of environmental concern. (Koltonuk 2020.)

Creating impact through venture capital and mentoring

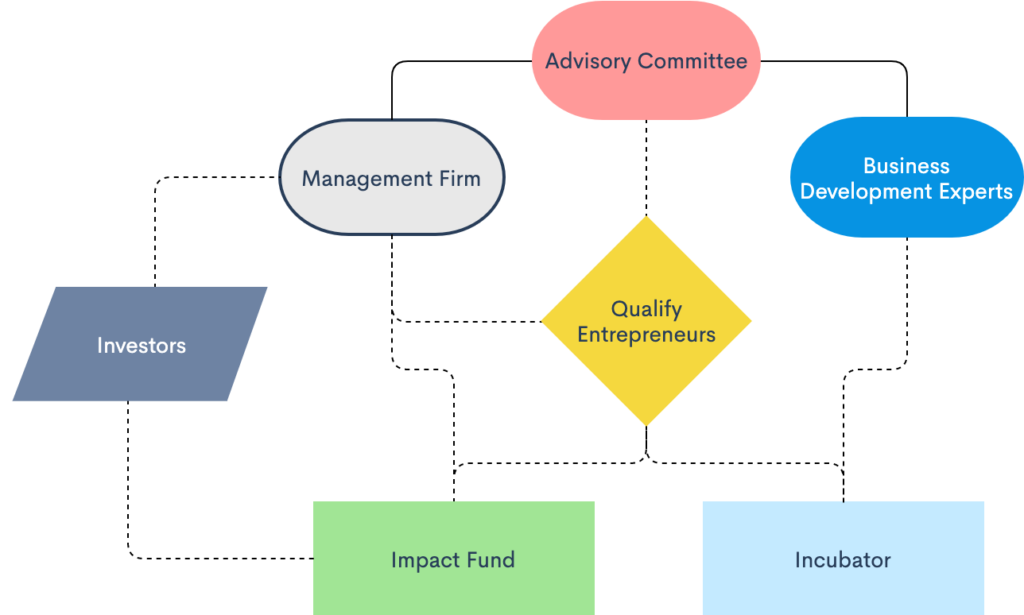

Given the investor-community trust issue and the reality that Lapland faces environmental threats from certain business activities, a sustainable solution for structuring investment in the region can be of great benefit to both the environment and investor relationships. In his thesis, Koltonuk (2020) proposes a platform comprised of a venture capital-managed impact fund and parallel small business incubator. To ensure that any such fund and support program for businesses operates in the best interest of the region and ensures sustainable development, it is recommended that this is overseen by an advisory committee consisting local stakeholders including business leaders, regional government authorities, indigenous community representatives, sustainability experts, researchers, and others (Figure 1).

Figure 1. Proposed investment platform (Koltonuk 2020)

The framework discussed by Koltonuk recommends cooperation between the advisory committee and the venture capital firm managing the impact fund. This collaboration would serve to draft guiding principles that address impact created through sustainability, assess potential portfolio companies for suitability, and determine indicators for evaluating impact and success. Regarding the assessment of potential recipients of funding, it is recommended that less-visible industries such as food (particularly natural foods) and renewable energy are prioritized as well as those small businesses that are located outside of main population centers.

The incubator, therefore, would serve to support businesses not receiving or requiring funding, but are in need of expert guidance – especially with regard to improving or implementing sustainability initiatives. It is noted that understandings of sustainability and sustainable business can vary widely among Lapland’s entrepreneurs and business leaders, though it is a shared assessment among experts that the local community is committed to sustainability as a matter of responsibility and is poised to progress considerably in this area.

References

Business Index North. 2020. Innovative business in the Arctic: Many ways to success. Business Index North Special Issue 1/2020, 4, 9-11, 16.

House of Lapland. 2020. Sustainable Tourism and Responsible Travel. [Cited 1 Jul 2020]. Available at: https://www.lapland.fi/visit/sustainable-tourism/

Kaivosvastuu. 2020. Finnish sustainability standard for mining translated into English [Cited 10 Aug 2020]. Available at: https://www.kaivosvastuu.fi/finnish-sustainability-standard-for-mining-translated-into-english/

Koltonuk, D. 2020. The Impact of Environmental Sustainability on Venture Capital, Private Equity, and Investor Relations: Exploring Lapland, Finland as a space for sustainable investment. LAB University of Applied Sciences, Faculty of Business and Hospitality Management. Lahti. [Cited 16 Nov 2020]. Available at: http://urn.fi/URN:NBN:fi:amk-2020111222737

Middleton, A. 2020. Arctic development in light of climate change and COVID-19 impact. AIAF, 1.

Authors

Daniel Koltonuk is studying in the MBA, International Business Development program at LAB University of Applied Sciences.

Brett Fifield is a Principal Lecturer in International Business at LAB University of Applied Sciences.

Illustration: https://pxhere.com/fi/photo/733254 (CC0)

Published 17.11.2020

Reference to this article

Koltonuk, D. & Fifield, B. 2020. Investing in sustainability and emerging industry – growing Lapland responsibly. LAB Pro. [Cited and date of citation]. Available at: https://www.labopen.fi/en/lab-pro/investing-in-sustainability-and-emerging-industry-growing-lapland-responsibly/